How Is Car Duty Calculated in Kenya?

Importing a car in Kenya requires understanding the complexities of calculating import tax and duty. As an aspiring car importer, you must understand the process to ensure compliance and avoid any unexpected costs. This blog post aims to make the calculation process easier to understand by breaking it down into key components, explaining applicable rates, and providing practical examples. By following these steps, you will be able to confidently navigate Kenya’s import tax and duty landscape.

You should consider consulting with a reputable customs clearance agent or goods forwarding company for assistance and staying up to date on any changes in Kenya Revenue Authority (KRA) regulations or rates. At UK RoadRunner we guide our clients through the process of calculating the estimated car import duty, keeping an open and honest communication channel.

Understanding Key Terms Used When Importing a Car to Kenya.

Before beginning the calculation process, becoming acquainted with key terms related to car import duty in Kenya is critical. KRA determines the current retail selling price (CRSP) to determine the value of the vehicle. The vehicle’s registration age, referring to the month and year of registration, influences the depreciation rate applied to its value. The engine capacity determines the excise duty, and the type of fuel (diesel, petrol, hybrid, or electric) can also impact it. Customs duty is based on the car’s customs value, whereas excise duty is based on the engine capacity.

Current Retail Selling Price (CRSP)

The Current Retail Selling Price (CRSP) is the first step in determining the import duty for a car in Kenya. The Kenya Revenue Authority (KRA) provides the CRSP, which is used to value the vehicle.

Depreciation

The age of the car is the next factor to consider once you have the CRSP. KRA applies a depreciation rate based on the vehicle’s age, which affects the customs value. Depreciation rates vary depending on age, ranging from 5% for vehicles registered within the last 6 months to 70% for those aged 7 years or older.

Engine Capacity

The engine capacity of the vehicle is a factor when calculating the import duty. A larger engine capacity usually translates into a higher duty payable.

Car Import Duty

The customs authorities calculate the duty on car imports as a percentage of the CRSP. Currently, they have set the duty rate at 35% of the CRSP value. To calculate the import duty, multiply the CRSP by 0.35.

Excise Duty

In Kenya, excise duty is levied on imported vehicles based on engine capacity and fuel type. The excise duty rate for cars with engine capacities of 1500 cc and less is 20% of the sum of the CRSP and import duty. However, for vehicles with displacements greater than 1500 cc, the excise duty rate rises to 25% of the same amount. This rate increases further depending on the engine capacity. It is important to note that the type of fuel (diesel, petrol, hybrid, or electric) also has an impact on the excise duty amount.

VAT (Value Added Tax)

Value Added Tax (VAT) is another component in the calculation of import duty. The KRA levies a 16% VAT on the total of the CRSP, import duty, and excise duty. To calculate the VAT payable, multiply this total by 0.16.

Additional Fees

In addition to the import duty, excise duty, and VAT, there may be additional fees. The Import Declaration Fee (IDF) is 2.25% of the CRSP or a minimum of Ksh. 5,000, whichever is greater. The Railways Development Levy, which is 2% of the customs value (CRSP + import duty + excise duty), is also applicable.

Clearing & Freight Forwarding Costs

It is critical to consider the costs of car import clearing and freight forwarding. These fees cover the costs of importing the vehicle, such as dealing with carriers, legalities, and insurance. It is best to consult with a reputable car import clearing and forwarding company to get an accurate estimate of these costs.

How to Calculate your Import Duty/Tax from an example:

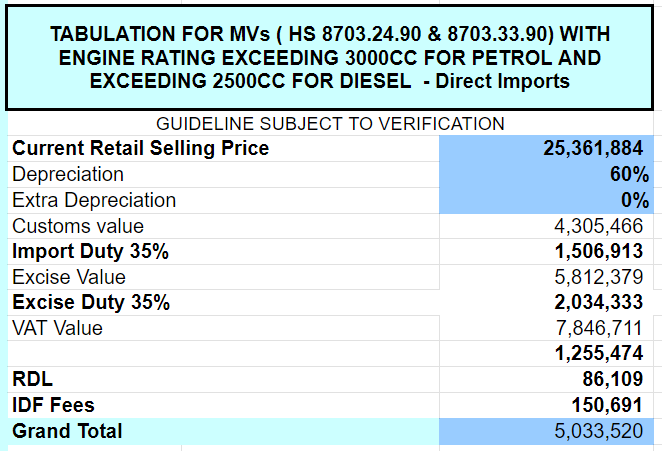

Consider this Land Rover Range Rover 3.0 TDV6 VOGUE. The vehicle was registered on 16/09/2017. It has its engine capacity and fuel as 3.0L and diesel respectively.

Here’s how to go about it;

The Vehicle CRSP is KES 25,361,884 from KRA. The Import duty is 35% of the customs value. The Customs value is derived after depreciation. The Depreciation rate (based on vehicle age): 60% (Since it turns 7 years in September 2023, it is now still greater than 6 years but less than 7 years). The VAT is 16% of the sum of customs value, import duty, and excise duty. Excise duty is 35% of customs value.

The fees for additional services (IDF, Railways Development Levy) will be calculated separately. Costs for clearing and forwarding are obtained from the freight forwarding company.

Conclusion

Importing a car to Kenya from the UK, Japan, Singapore or Thailand and calculating the associated import duty can be a time-consuming process. However, with UK RoadRunner, you can streamline the process and ensure a smooth experience. Our team understands the complexities of Kenya Revenue Authority regulations and can assist you in accurately calculating the import duty, considering factors such as CRSP, depreciation, engine capacity, and applicable taxes. We will provide you with our expertise, excellent customer service, and open communication. Allow us to streamline your car import process and turn your dream of owning a car in Kenya into a reality. Contact us for a stress free experience.